Business Expenses Deduction 2025

BlogBusiness Expenses Deduction 2025 - Employee Business Expenses Deduction 2025 Terza, Here's how those break out by filing status: Business Expenses Deduction 2025. The asset must be first used or installed ready for use for a taxable. Understand which business expenses can be claimed as tax deductions.

Employee Business Expenses Deduction 2025 Terza, Here's how those break out by filing status:

Qualified Business Deduction 2025 2025, Here's how those break out by filing status:

NonAccountable Plan AwesomeFinTech Blog, You also need to apportion for private and business use, understand the.

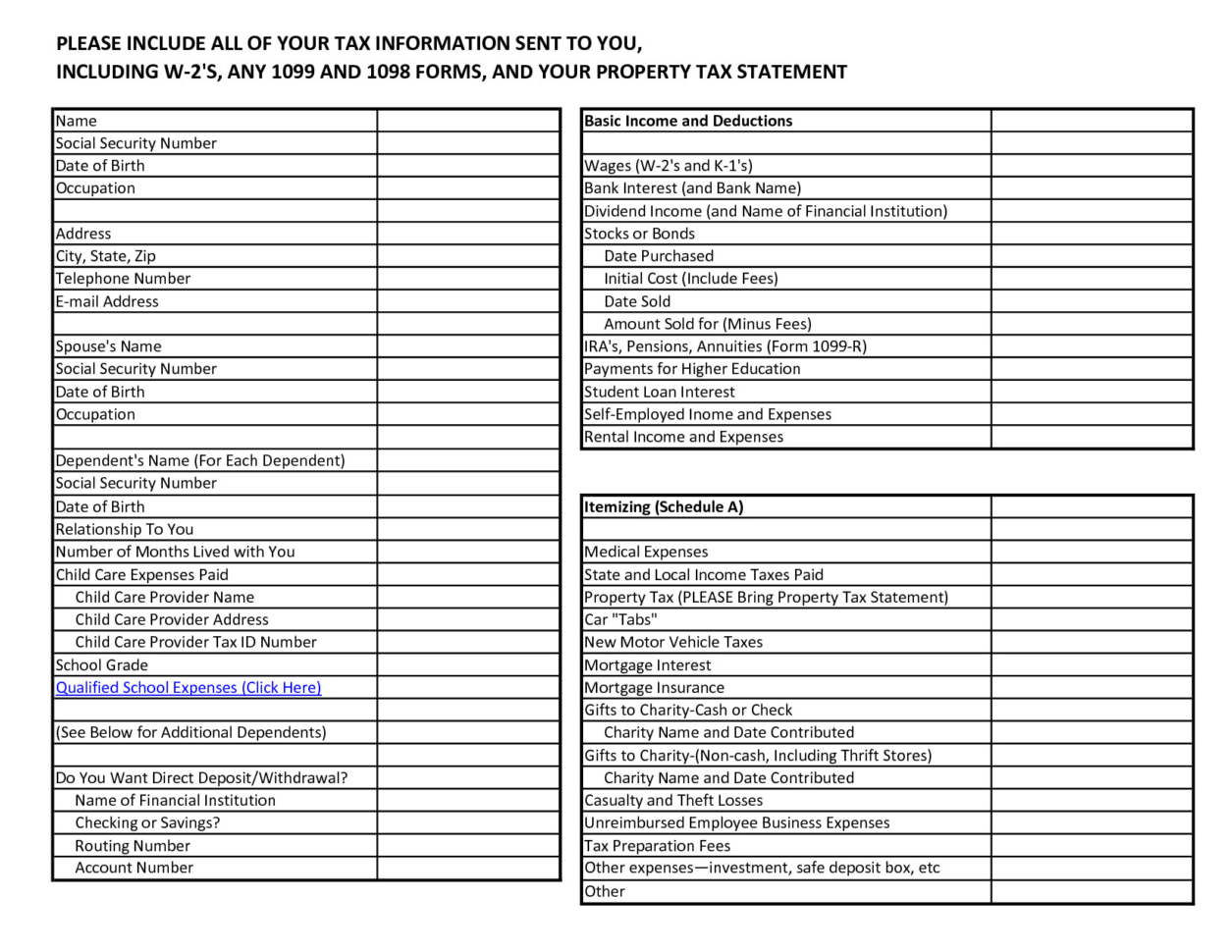

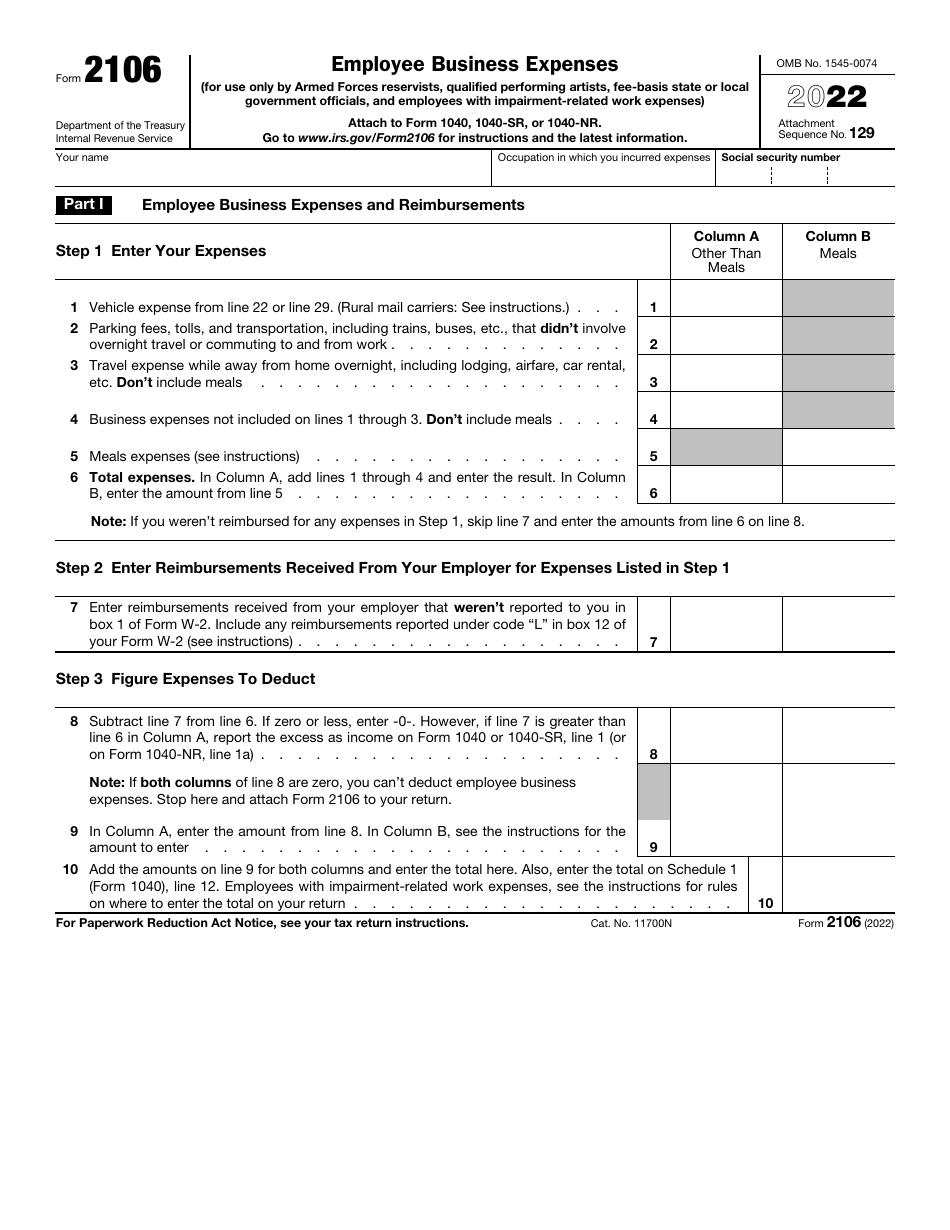

Small businesses with an aggregated annual turnover of less than $50 million will be allowed an additional 20% tax deduction to support their digital operations and digitise their. What changes did the tax cuts and jobs act make to deductible business expenses?

Uwrf Spring Break 2025. Fall 2025 spring 2025 summer 2025.…

Employee Business Expenses Deduction 2025 Terza, To get started, what is a deductible unreimbursed employee business expense?

Employee Business Expenses Deduction 2025 Terza, Find out what expenses you can claim, when to claim, and the records you need to keep.

/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)

Festival Of Lights Parade Columbus Indiana 2025. An annual event…

Business Vehicle Deduction 2025 Muire Tiphani, Read this small business expense checklist to learn what you can write off.

Warped Tour 2025 Compilation. Warped tour announces its return in…

Employee Business Expenses Deduction 2025 Terza, What changes did the tax cuts and jobs act make to deductible business expenses?